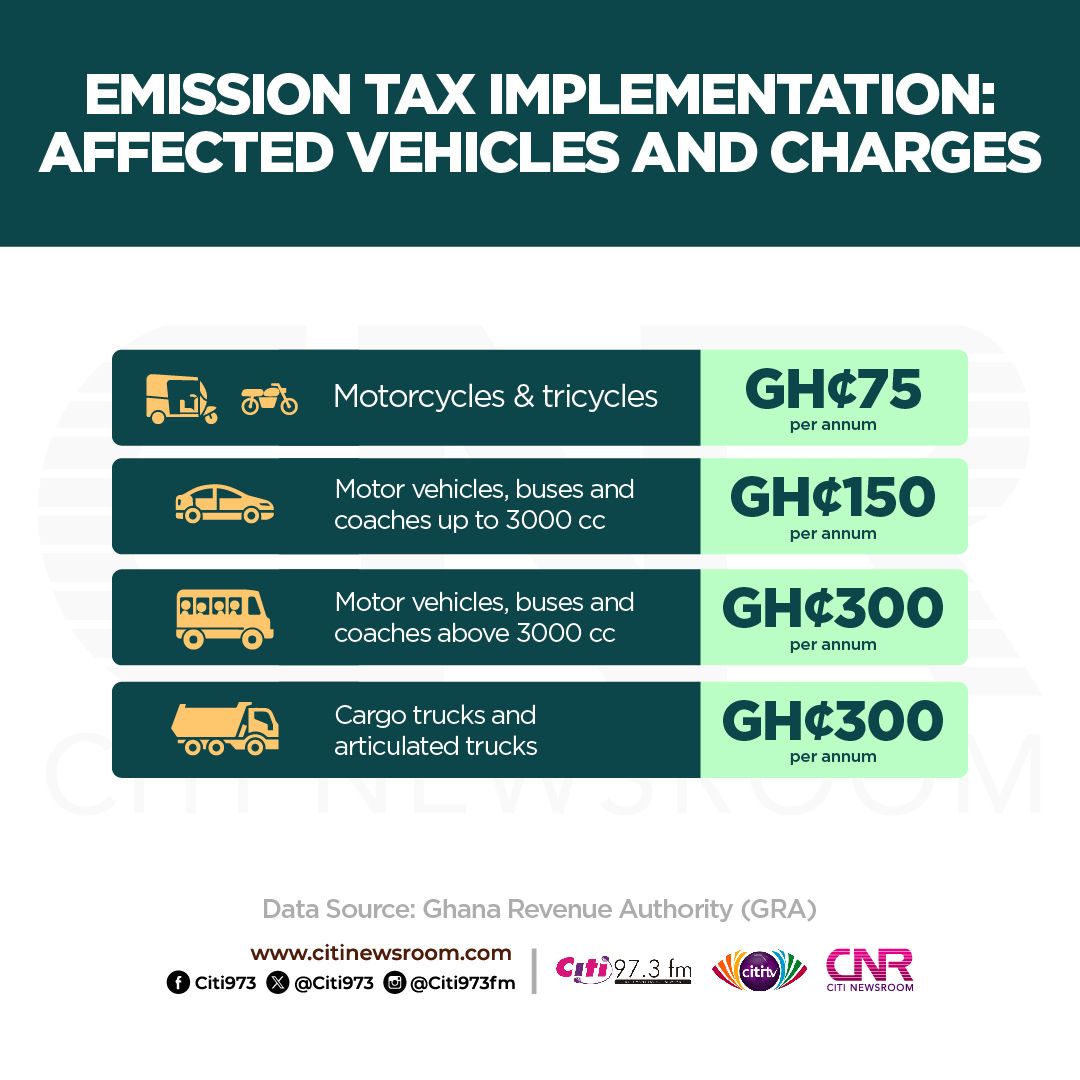

The Ghana Revenue Authority (GRA) has announced the commencement of the implementation of the Emissions Levy Act, 2023 (Act 1112) effective Thursday, February 1, 2024.

According to the GRA, the Act imposes a levy on carbon dioxide equivalent emissions on internal combustion engine vehicles.

The GRA emphasised that the move aligns with the government’s commitment to addressing greenhouse gas emissions.

Apart from vehicles, the law imposes a levy of GH¢100 per tonne on carbon dioxide equivalent emissions from electricity producers as a statutory obligation.

However, per the Power Purchase Agreements (PPAs) with power producers, this legislation is a political risk (an increased cost event) mitigated by an increased costs clause in the agreements, which suggests a pass-through mechanism whereby economic consequences go to the end user.

As a direct consequence of this statutory obligation on the power producers, there will be an upward adjustment in the cost build-up of electricity generation. Power plant management and operation is cost-sensitive, just as in the downstream petroleum sectors. Specifically, the levy will be added to power plants’ operational costs build-up.

Implementing the Emissions Levy Act, 2023, necessitates an equal measure of the electricity generation tariff review to ensure the power producers predictability of cash flow obligations; and this adjustment is essential to cover the increased operational costs induced by imposition of the Emissions Levy, to ensure operational reliability and sustainability.

At the end of day, the final customer will carry the burden of this legislation.

The writer is a power systems economist & CEO-IPGG

The post Impact of the Emissions Levy Act on electricity generation tariffs appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS