Quick Credit and Investment Micro Limited, a leading financial institution in the country, has revealed that it disbursed a sum of GH¢1.7billion to its customers in 2023 compared to GH¢980million the previous year.

This was announced during the company’s just ended end-of-year durbar that took place in Accra. It was themed ‘Our Year of Innovation and Reforms’.

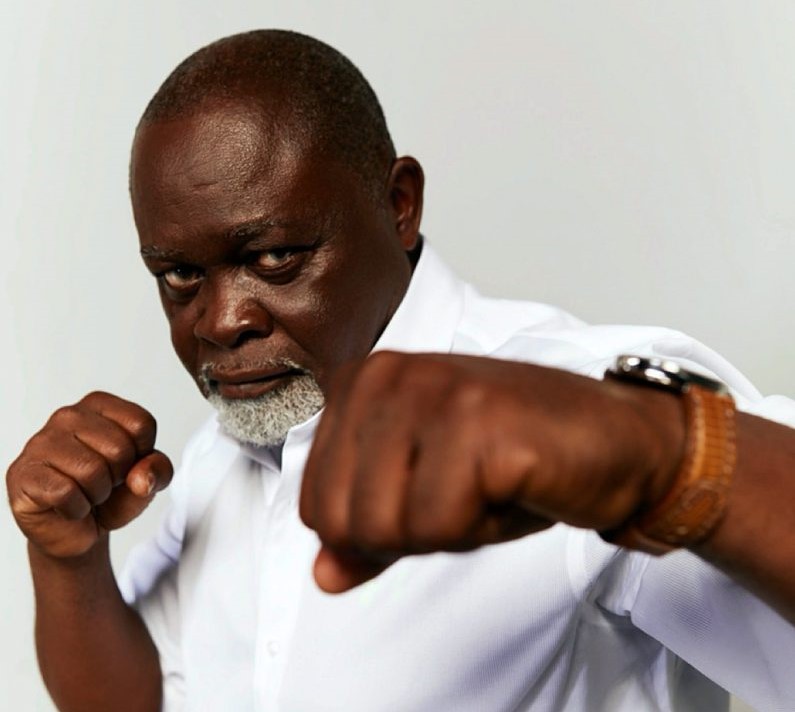

Speaking at the event, Founder and Board Chairman of Quick Credit, Richard Nii Armah Quaye, described the company’s accomplishments in 2023 as ‘outstanding’. Despite the difficult operating environment, Mr. Quaye said Quick Credit was not only able to meet expectations but exceeded its goals in terms of support for customers and the economy.

“I am thrilled to report to you that we exceeded our targets by disbursing an incredible amount of GH¢1.7billion compared to the GH¢980million disbursed in 2022,” he said.

While counting the successes chalked up by his outfit in 2023, Mr. Quaye added that the company’s loan portfolio grew from GH¢332.7million in 2022 to an impressive GH¢755.1million in 2023.

According to him, what makes this feat unparalleled is that Quick Credit achieved it without accepting deposits or investments from the general public. This gesture, he explained, demonstrates his team’s commitment to providing financial assistance and opportunities to individuals and businesses throughout the nation in a bid to create business opportunities.

“Our focus remains being a lending institution with a strong customer relation to enhance sustainability and impactful mutual growth,” he reiterated.

To consolidate gains made over the years, he highlighted that the company is resolved to advance its technology so as to improve on service delivery and provide seamless and effective communication in its operations, in line with the country’s drive toward digitisation. “We have also resolved to continue our journey of enhancing technology in our business, to improve our service delivery and make us more effective and efficient in our operations and ultimately reduce our cost of doing business”.

Mr. Quaye lauded the employees of Quick Credit for their remarkable commitment and dedication, adding that employees are the lynchpin for success in every organisation.

He further urged staff of the company to continue with their hard work as the company strives to attain greater heights. “Dear team, management comes to you yet again with 2024 targets. These we know are ambitious targets, but we are confident of our ability to achieve these targets as we have always done over the years.”

House-to-house recovery of loans

The management of Quick Credit also announced that the company will no longer undertake house-to-house recovery of loans from defaulting customers.

Mr. Quaye explained that as an institution built on a culture of customer-centric principles, it has been an unalloyed honour for management to dissolve its house-to-house recovery of loans from defaulting customers, following feedback from its stakeholders.

“Over the past year, we received numerous feedbacks from our customers, the general public, and our regulator on our activities in the field. These feedbacks reflect the experiences and expectations of the people we serve. I am thrilled to announce that we have taken a decision to dissolve the house-to-house recovery department of the company, and will no longer be visiting clients for recovery ever again. Instead, we will employ alternative and more suitable means to recover our non-performing loans,” he said.

15th anniversary

Having spearheaded innovations and tailored products and services in the financial industry over the years, he said the company is ready to observe this milestone with diverse activities scheduled for the second quarter of this year.

“I am excited to stand before you today to announce a momentous occasion—the 15th anniversary of Quick Credit that falls in April this year. In honour of our crystal anniversary, we have planned a series of exciting activities including corporate social activities and events to involve both our internal team and the community at large.

“These activities aim to not only celebrate the past but also inspire and set the stage for an even brighter future,” Mr. Quaye said.

The celebrations, he noted, will provide platforms to not only commemorate Quick Credit’s past achievements but also motivate and create a foundation for a more promising future.

About Quick Credit

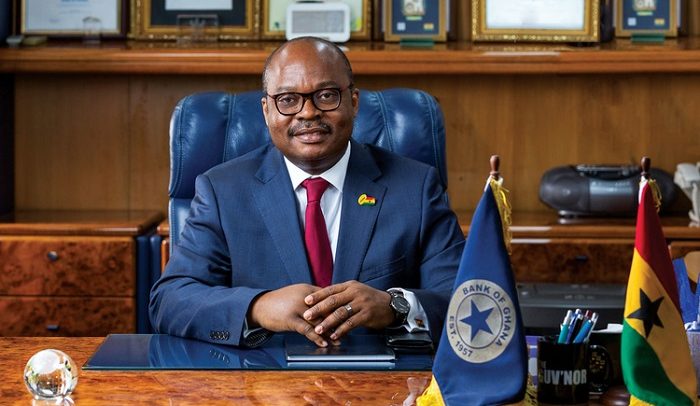

Quick Credit and Investment Micro-Credit Limited was incorporated on 9th December 2011. Quick Credit is licenced by the Bank of Ghana to operate as a Lending Institution under the Non-Bank Financial Institutions (NBFI) Act.

Quick Credit is an award-winning Micro-Credit institution in Ghana, with a customer-centric culture managed by an experienced team and having a diverse portfolio in financial services.

In 2020, during the pandemic, the company experienced a transition from 25 branches nationwide to a branch-less institution; operating remotely across the country with over 80 call centre executives employed.

Over the last decade, Quick Credit and Investment Micro-Credit has lived its mission of supporting small businesses to grow through its loans.

As an innovative financial firm, it does not take any form of deposit or do susu or take any form of investment from clients. Its main business is to give loans to small businesses to spur their growth.

Currently, over 315,113 Ghanaians have access to the company’s loans. Quick Credit also boasts 1,500 workers. The business intends to consolidate its position as the leading credit service provider recognised for excellent customer service.

The post Quick Credit disburses GH¢1.7bn to customers in 2023 appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS