Initial checks by Citi Business News have revealed that some foreign exchange bureaux have not fully complied with the Bank of Ghana’s new directive on transactions.

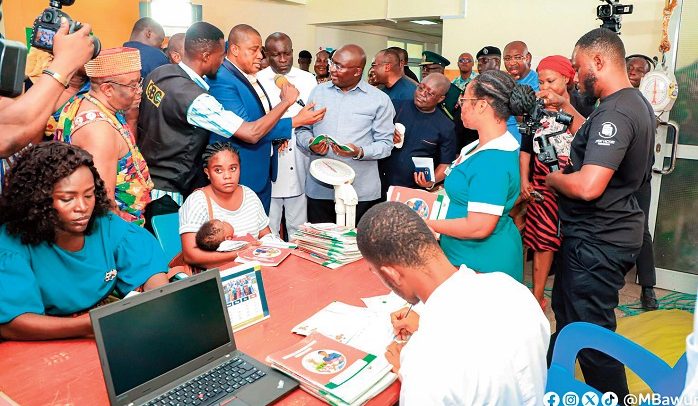

The directive which took effect on Thursday, August 1, 2024, requires all licensed foreign exchange bureaux to request the Ghana Card before completing any transactions.

During visits to various bureaux, it was observed that the Ghana Card was not requested before transactions were conducted.

Customers were seen engaging in currency exchanges without presenting their Ghana Cards, and attendants were processing transactions without verifying the identification through the Ghana Card.

This inconsistency was noted across multiple bureaux visited.

Furthermore, many bureaux have yet to update their systems to align with the new platform requirements.

Some claimed they hadn’t heard about the directive, while others indicated they would need until the end of the week to fully comply.

Some were observed conducting transactions without inputting card details into any system.

Citi Business News observed some dealers requesting the card, but they proceeded with transactions when customers said they did not have them.

Some dealers who spoke to Citi Business News off the record expressed concerns about the impact on their business, noting that they already struggle to attract customers.

They mentioned that they are unsure if they can immediately turn away the fees they collect due to the Ghana Card requirement, and stated they would need about a week to sensitize their customers before they can insist on the new mandate.

The directive, as explained by the Bank of Ghana, aims to curb illegal forex activities and promote financial accountability.

Director of Operations at Dalex Finance, Joe Jackson proposed stabilising the cedi and ensuring its availability as more effective measures to deterring grey market operations.

“That grey market is the issue. The people who participate in the grey market know themselves very well. The only way to keep people from the grey market is to stabilize the cedi and make it widely available.”

“The measure of not allowing forex bureaus to advertise is a trap. We want it to be competitive so patrons and customers can opt for places with the lowest rates and, with that, keep the market stable. Not asking them to advertise their rates will only drive it deeper into the grey market, compounding the issues.”

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS