The World Bank, as we all know, is about financing development to eliminate poverty. Eliminating poverty in the developing world where it is most endemic entails investing in the productive capacity of the economy to put millions in decent, empowering, nation-transforming work.

In most economies, one cannot talk about “productive capacity” without talking about the private sector. This is why the World Bank has a fully-fledged private sector arm called the International Finance Corporation (IFC).

Being an integral part of the World Bank, it is not surprising that the IFC’s twin mandate is ending extreme poverty and creating shared prosperity. As it boasts in its latest annual report, it is working towards “a more virtuous cycle?—?one that ends poverty, protects the planet, and creates inclusive growth.”

Given the scarcity of capital in places like Ghana, it would be strange if the IFC’s investments do not prioritise projects that build local capacity, inclusive prosperity, and structural transformation. Just like it says in its own strategy handbook.

In a portfolio of just 23 active investments in the course of the decade up to 2022, one can forgive the odd luxury mall. But within three years of investing in Accra Mall in 2012, the IFC had already approved another such investment, a $60.5 million loan for a sprawling complex called The Exchange in Ghana’s plush Airport City.

Architect’s impression of The Exchange in 2016. Source: HOK

Combining a luxury (Radisson Blu) hotel, luxury mall, and luxury condominium, The Exchange was touted as West Africa’s “largest mixed-use complex”. IFC’s investment came at a time when private investors were blanketing Accra with luxury shopping, residential, and hospitality facilities and when many analysts were already warning of pending oversaturation.

Since investing in The Exchange, the IFC has doubled down on more luxury malls and shopping complexes, as well as condos, including a swanky aparthotel called One Oxford Street, where nightly rates routinely top $400 a night, higher than the average monthly salary of most waged workers in the country. The saturation level of luxury real estate in Accra is at a point where 80% of planned construction is now on hold.

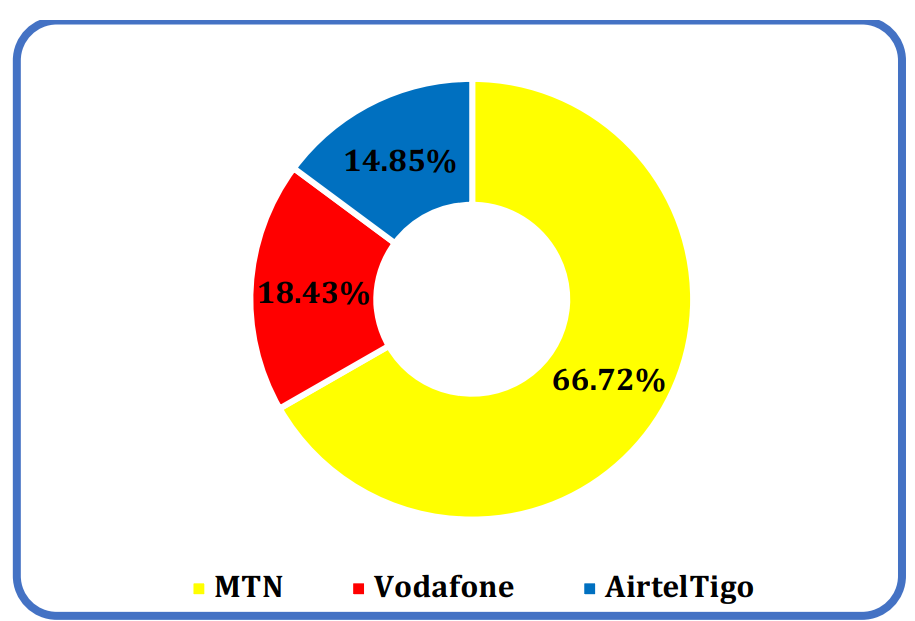

The most curious thing about the IFC’s investment strategy in Ghana is the almost complete neglect of some key productive sectors such as agro-processing, biotech, chemicals (especially pharmaceuticals), transportation, logistics, ICT, and human capital skills, even though national development strategies, transformation reports, and the domestic development finance agenda prioritise these sectors. Equally curious is the organization’s aloofness where the country’s social enterprise and youth innovation ecosystems are concerned.

There is no point being coy about the IFC’s need to generate a profit. Whilst social impact is of course paramount, its DFI model requires it to also pursue a sound financial return on each investment. Could the love for luxury real estate and the seeming disdain for agrotech and social enterprises stem from sensible financial risk avoidance, seeing as even some local commercial banks tend to steer away from some of these sectors?

Such thinking, though, would constitute a lack of ambition on the IFC’s part. An organisation that returns just 1.5% on capital cannot also lack spunk. But on the issue of risk, the IFC’s investment in The Exchange shows that risk can be highly project-specific so avoiding whole sectors as a way around it is a short-sighted strategy.

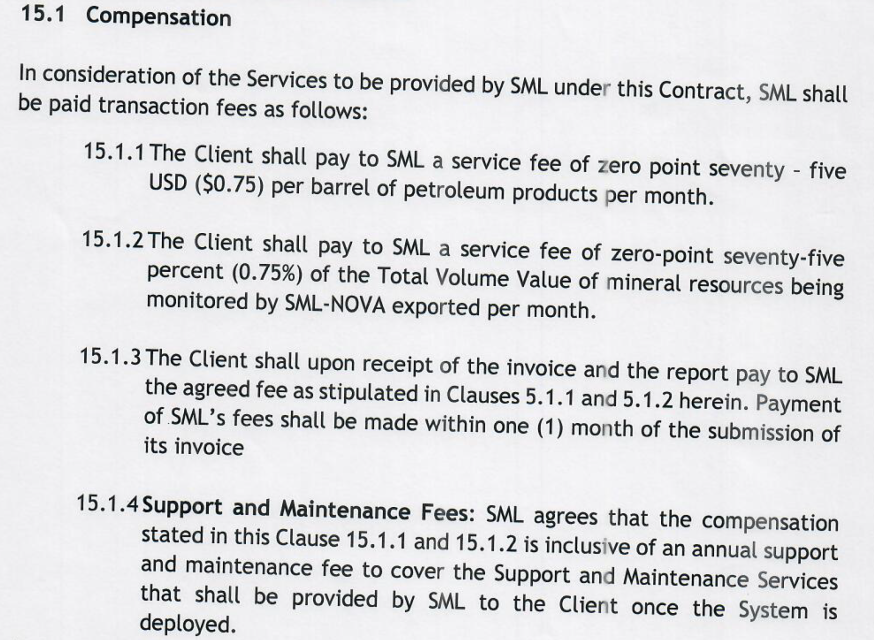

IFC issued the $60 million loan for The Exchange in the name of Actis, a global investment firm focused on emerging markets that likes to tout its social impact. The prime land in the nation’s most sought-after location, the Airport City, and the entrepreneurial vision, were supplied by Mabani Seven, part of the Forewin Conglomerate. Forewin cut its teeth and made its fortune from the merchandise import trade. Mabani Seven formed an SPV with Actis and the British private equity firm, CDC, and took a 49% stake in The Exchange. In addition to the IFC, other development finance institutions like FMO and the OPEC Fund came on board as sponsors.

With the $60.5 million in hand, the SPV, which had hired a consulting architect (HOK), an engineering services firm (Dar-al-handasah), a project manager (Profica), and a lead contractor, went into fifth gear.

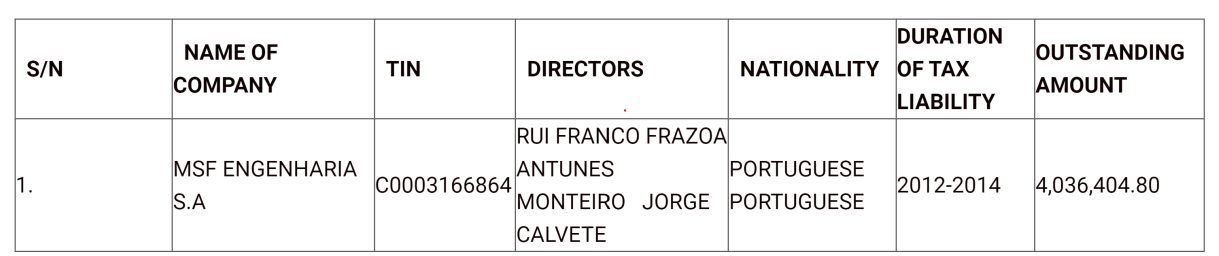

A large advance payment was wired straight to Europe for the benefit of Portuguese firm, MSF Engenharia, the lead contractor. MSF Engenharia set up a front office with thin staffing in Ghana, hired another Portuguese firm, Confrasilvas, to handle principal formworks, and commenced work.

Midstream during construction, MSF Engenharia went bankrupt and its various entities in Europe were fully liquidated, leaving its Ghanaian shell effectively orphaned. Since the project had been insured with insurance bonds (local commercial banks wouldn’t touch the risk), Mabani Seven proceeded to the courts to cash out on the insurance bonds to pay its creditors, the DFIs, IFC paramount among them. The lawsuits quickly degenerated into a spaghetti mess, derailing the entire project. The site of The Exchange is now a fenced derelict patch.

The only reason any of this information is being made available in the public domain is because of court proceedings. Nowhere on the project page on the IFC’s website would the reader find any useful disclosures, even though records in the said court proceedings suggest that as much as $57.5 million of the $60.5 million loan facility was imperilled following MSF Engenharia’s liquidation.

The entire matter is now shrouded in considerable legal murkiness, with an appeal regarding the continued servicing of the insurance bonds by the local insurers now pending before Ghana’s choked supreme court.

Apart from the opacity of these transactions, which effectively nullifies the IFC’s transparency pledge, the extent to which the IFC will often go to protect its commercial interests also regularly presents massive reputational risk, as we have seen in the Bridges Academies case and the Africa’s Talking case. The failure of the IFC to conduct proper due diligence on MSF Engenharia further amplifies these serious reputational concerns. Around the same time that the firm was engaged, it had already been spotlighted for executing just 6% of road projects awarded to it after missing deadlines. Even more pertinently, it had been indebted to the Ghanaian tax authorities for three years.

When MSF Engenharia failed, local Ghanaian subcontractors were left holding the can even as the IFC deployed high-powered lawyers to retrieve its own cash. Ghana’s historically undercapitalized insurance industry is now on the line for millions of dollars in liabilities. The five insurance companies directly exposed to the default risk some capital impairment in the event of reinsurance gaps. Indeed, when their bonds were called by the Project Sponsors, and before the courts got involved, the insurers had negotiated to settle in instalments.

What we are seeing, therefore, is an effective transfer of liability from a Portuguese corporation to beleaguered Ghanaian entities courtesy of an IFC-funded project. One of the exposed insurance companies, Star Assurance, lists the default claim related to The Exchange, a sum of $5.8 million, as its largest payout in recent times. Local contractors like Man Construction, which was brought in later to ensure that the abandoned structures do not pose a safety threat, also struggled to be paid.

Six years after it was scheduled to open, the site of The Exchange resembles the ruins of a cautionary monument to the perils of commercial real estate.

“Ruins” of The Exchange. Image Source: Construction Media Ghana

Ghanaian businesses have lost money, the IFC would very likely lose money, and the community is worse off for it.

The debacle of The Exchange is clear proof that favouring projects that look like they could make lots of money quickly because they cater to the elite is not any less risky than collaborating with others in the ecosystem to make patient investments in critical sectors like agro-processing and skills-intensive ICT.

The Exchange’s $435,000-priced 1-bedroom units would definitely have made a few random multimillionaires happy in Accra, but it is doubtful how much joy they would have created in the broader Ghanaian economy even if the project had worked out. What is for sure is that, for now, everyone has ash in their mouths.

—-

Explore the world of impactful news with CitiNewsroom on WhatsApp!

Click on the link to join the Citi Newsroom channel for curated, meaningful stories tailored just for YOU: https://whatsapp.com/channel/0029VaCYzPRAYlUPudDDe53x

No spam, just the stories that truly matter! #StayInformed #CitiNewsroom #CNRDigital

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS