By Kizito CUDJOE

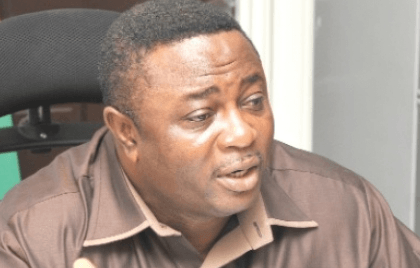

Commissioner-General-Ghana Revenue Authority (GRA) Anthony Kwasi Sarpong has reaffirmed the tax agency’s readiness to roll out the Fiscal Electronic Device Act, 2018 (Act 966), as part of broader reforms to the Value Added Tax (VAT) regime.

The law, which came into force on May 4, 2018, mandates the use of approved Fiscal Electronic Devices (FEDs) by specified taxable persons at each point of sale. Its aim is to enhance revenue mobilisation by ensuring accurate transaction records and improving compliance.

GRA, according to Mr. Sarpong, intends to accelerate the expansion of VAT coverage across the retail and service sectors, viewing it as a consumption tax with significant untapped potential. “If we are able to do that, it creates more opportunity for us to even review the rate in future,” he said.

The Commissioner-General made these remarks when highlighting ongoing legal reforms in the VAT space at Accra during a courtesy call by some senior management of Gold Fields Ghana. The reforms being undertaken by government are expected to be presented in parliament by October this year, with implementation targetted for early 2026.

“One of the key things we are doing is to remove the COVID levy and decouple some levies which, in their current form, lead to an effective VAT rate of 21.9 percent,” he explained.

“Eight percent of that is not recoverable, meaning it becomes a cost to businesses. Under proposed reforms, the effective rate will be 20 percent and the entire amount will be deductible. This way, we are not adding extra costs for businesses.”

Beyond VAT reform, Mr. Sarpong said GRA is working with relevant authorities to establish an Independent Tax Appeal Board (ITAB) before end of the year. The board, once operational, will provide a platform for resolving tax disputes without resorting to courts – a move aimed at reducing the time, cost and adversarial nature of current processes.

“That gives us, as the tax administrator and taxpayer, an opportunity to resolve matters at this body without going to court,” he said. “It is less confrontational, faster and gives everyone an opportunity to feel at home in resolving tax disputes.”

He stressed that the initiative also reflects President John Dramani Mahama’s call for GRA to adopt a more “human-centred” approach, treating taxpayers as customers and partners in national development.

The GRA also plans to intensify nationwide tax education by end of the year, Mr. Sarpong disclosed. He noted that many citizens, including highly educated individuals, either lack a full understanding of their tax obligations or are reluctant to comply.

“One of our goals is to conduct intensive education across all sectors and levels and simplify tax processes for small and medium enterprises,” he said. “When these businesses understand and participate in the tax system, we all benefit and it creates room for possible rate reviews in the future.”

The Commissioner-General emphasised that these reforms – spanning legislation, dispute resolution, compliance technology and public education – are part of a coordinated effort to modernise Ghana’s tax administration, broaden the revenue base and create a fairer business environment.

Gold Fields Ghana’s visit, he added, is a reminder of the private sector’s important role in revenue mobilisation and economic growth. The mining company is one of the country’s top taxpayers, contributing significantly to government revenue and community development.

“With committed implementation of these measures, we believe the path ahead will be beneficial for both the tax authority and taxpayers – and ultimately for growth of the Ghanaian economy,” Mr. Sarpong said.

FACT BOX: Fiscal Electronic Device Act & GRA Reforms

Fiscal Electronic Device Act, 2018 (Act 966)

- Effective date: May 4, 2018.

- Purpose: Mandates the use of approved Fiscal Electronic Devices (FEDs) by specified taxable persons at every point of sale.

- Goal: Ensure accurate transaction records, curb under-reporting, and improve tax compliance.

VAT Reform Plans

- Current effective rate: 21.9% (8% is non-recoverable and a cost to businesses).

- Proposed change: Reduce to 20% and make the full amount deductible.

- Other measures: Remove COVID levy and decouple certain levies.

- Timeline: Legislative reforms to be presented in parliament by October 2025; implementation targetted for early 2026.

Independent Tax Appeal Board (ITAB)

- Purpose: Provide alternative dispute resolution between GRA and taxpayers without going to court.

- Benefits: Faster, less confrontational, cost-effective.

- Expected launch: By the end of 2025.

Tax Education Drive

- Target groups: All sectors, including SMEs.

- Focus: Simplify tax processes, improve understanding of tax obligations, encourage voluntary compliance.

- Objective: Broaden tax base and create room for possible rate adjustments.

Commissioner-General’s Vision

- More “human-centred” tax administration.

- Treat taxpayers as customers and partners in development.

- Combine technology, education and legal reforms to modernise revenue collection.

The post GRA keen on implementing Fiscal Electronic Device Act – Commissioner-General appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS