It is argued that in Ghana Small and Medium Enterprises (SMEs) rely primarily on the personal savings of owners, business profits, family members or friends for their financial needs. In addition, many small businesses are believed to be running their operations from the personal account of their owners.

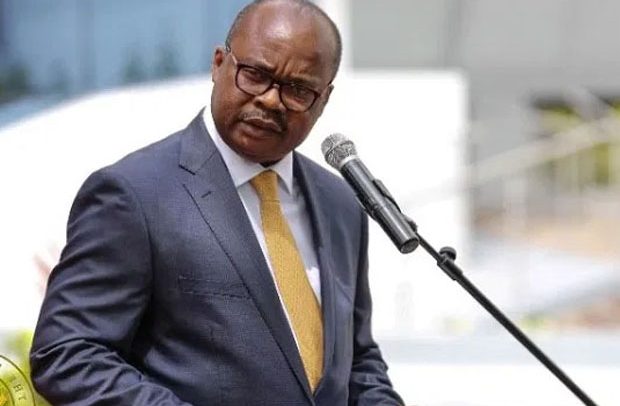

“The misconception is that running your business and personal finances though a single bank account will save money and spare the business owner the hassles of opening and running separate bank accounts,” the Head of Business Banking at First National Bank, Mark Achiampong, says. “However, there are several considerations which offset any perceived benefits.”

These considerations include:

- Legal considerations: For limited liabilities, the law makes room for distinctive separation between the person and the business. Using a company bank account can lead to legal issues for the business owner as well as tax issues. The business owner will need to understand the legal structure of the business to avoid legal pitfalls.

- Improved efficiencies: Keeping your business and personal financial activities separate decreases the complexity of understanding the performance of your business relating to cash management and cashflow for the business and the person. The alternative is to manually separate the respective activities, which is time consuming and subject to human error.

- Meticulous record keeping: This allows the business owner to manage and budget cashflow for the smooth running of the business. It also opens the door to categorising expenses, connecting accounting software to simplify your accounting and seeing real-time cash flow.

- Understanding business finances – by separating your business finances from your personal finances you are able to easily track, forecast and respond to fluctuations in your finances.

- Business valuation – In the event that at some point in time you wish to value your business or even sell it, you will require a clear separation of your business finances and a historic record of business activity, which a separate bank account will support.

- Credit applications: Many businesses do not yet have audited financial statements as a record of financial performance. This is where business bank statements come in handy, as a record of your trading activity – from which financial institutions can make lending decisions. It is important to note that business behaviour also counts. Keeping up with payments will help you improve your businesses credit score, and it’s easier to track business activity without personal finances muddling your statements.

- Professionalism: Having a business bank account gives your business a professional image and demonstrates that you are serious about your business. It also makes it easier for you to receive payments from customers, pay bills, pay employees and manage your finances.

- Compliance: Using a business bank account helps you to comply with regulatory requirements for businesses by allowing you to keep accurate financial records, which is helpful when it comes to paying taxes.

“At First National Bank, we are interested in helping you streamline your business and finances with a combination of tailored financial solutions, expert advisory, operational efficiencies, networking opportunities, risk management strategies, market insights and expansion guidance,” Mr. Achiampong added. With these services at your disposal, you can confidently embark on scaling up your business, realizing your ambitions and contributing to national economic prosperity.

The post Six reason why informal businesses should have a business bank account appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS