The Ghana Union of Traders Association (GUTA) has strongly opposed Value Added Tax (VAT) on electricity and the imposition of an Emissions Levy.

In a press statement, GUTA warned that the two taxes risk worsening the economic plight of Ghanaians and businesses alike, exacerbating the already high cost of doing business in the country.

The proposed VAT on electricity charges will directly impact businesses, particularly those heavily reliant on electricity for their operations. Such businesses will face increased financial strain, which could potentially lead to reduced production capacity, layoffs and even business closures and ultimately impede economic progress and dampen job creation opportunities, the release signed by president of the Association, Dr. Joseph Obeng, noted.

GUTA added that implementation of the Emission Levy will further compound the plight of businesses.

“Ghana already collects energy taxes, including petroleum tax on gasoline, diesel, kerosene and Liquefied Petroleum Gas (LPG). GUTA urgesthe government to reconsider these measures and engage in thorough consultations with key stakeholders, including the business community, before implementing any new taxation policies. It is crucial that the voices and concerns of businesses are heard and taken into account to ensure policies which do not hinder economic growth and investment,” the release noted.

GUTA further encouraged government to explore alternative means of revenue generation that do not place undue burden on businesses.

Emission Levy

The Emissions Levy is in line with government’s efforts aimed at tackling greenhouse gas emissions to promote the use of eco-friendly technology and green energy.

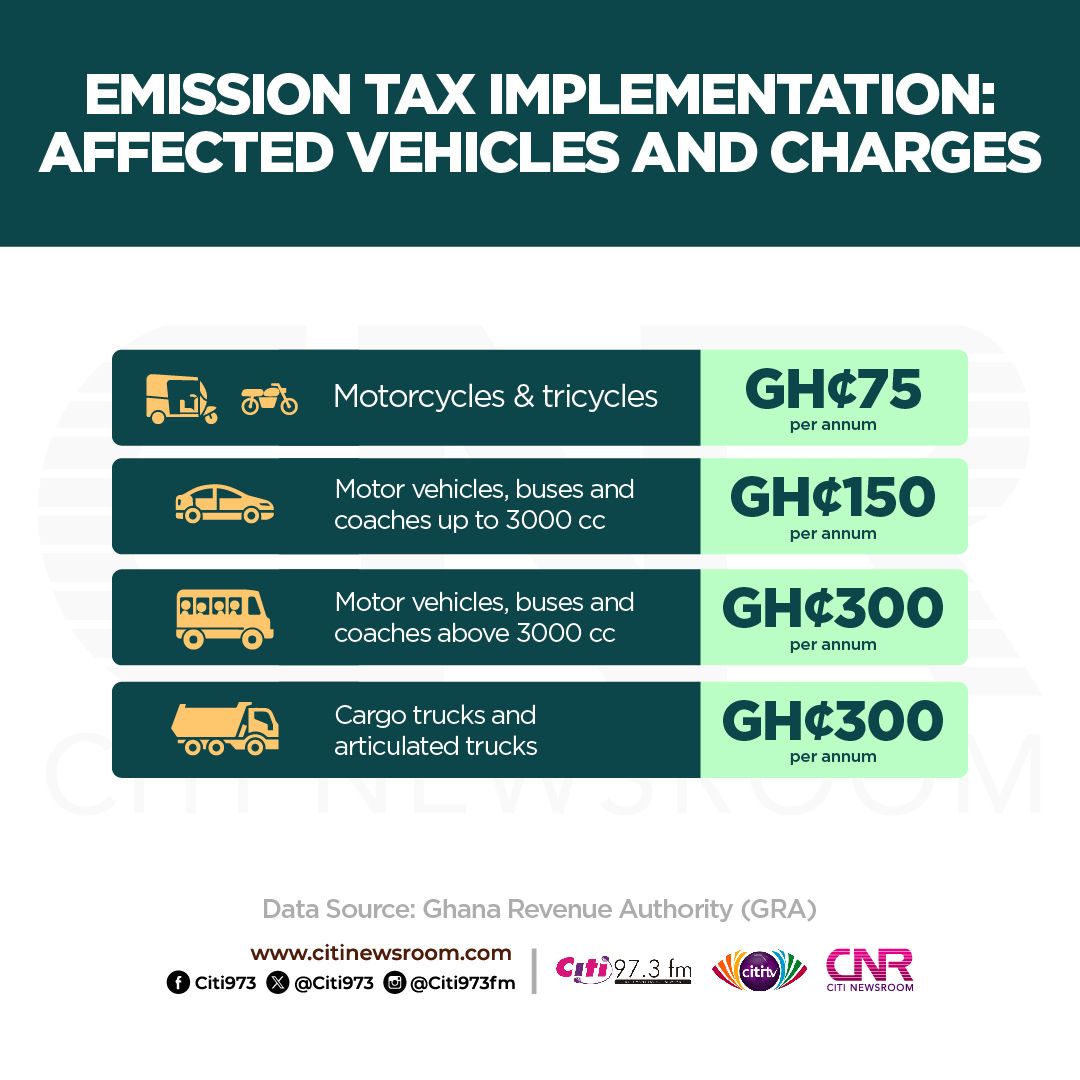

The levy amount varies based on the type of vehicle and its engine capacity. Motorcycles and tricycles are required to pay GH?75 per annum, while motor vehicles, buses and coaches up to 3,000 cubic centimetres are required to pay GH?150 per annum.

Motor vehicles, buses and coaches above 3,000 cubic centimetres, cargo trucks and articulated trucks are required to pay GH?300 per annum.

GUTA contends that despite passage and implementation of the VAT and Emissions Levy by parliament, there is still an opportunity for these decisions to be reversed.

The post GUTA kicks against VAT on electricity, Emissions Levy appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS