GCB Bank PLC has reported a record Profit Before Tax (PBT) of GHS 1.91 billion for 2024, a 25.3% year-on-year increase, marking the successful completion of its four-year strategic cycle.

Revenue grew by 19%, fueled by a 19.02% rise in interest income, a 42.72% surge in non-funded income, and an 8.41% increase in net trading income.

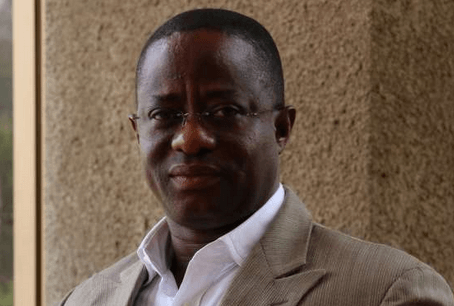

Managing Director of GCB Bank, Farihan Alhassan stated, “This is our best performance in history, but we aim to further enhance efficiency.”

“However, there is still room for improvement in our efficiency metrics. With sizeable investments in systems, talents, and people, we are on course to enhance efficiency across our network,” GCB Bank’s MD, Farihan Alhassan added.

Mr. Alhassan further opined that “with the steady improvement in the operating environment, we are determined to build on this momentum to drive growth in the years ahead.”

A customer-centric approach drove a 58% asset growth to GHS 42.58 billion. Deposits climbed by 58.1% to GHS 34.63 billion, while the loan book expanded by 52.83% to GHS 10.2 billion.

Shareholders’ equity rose by 44.72% to GHS 4.05 billion, strengthening the Capital Adequacy Ratio to 15.23%. The Non-Performing Loans ratio improved, dropping to 15.1%.

Despite rising costs, GCB Bank’s focus on digital transformation and market expansion positions it for sustainable profitability in its next strategic cycle starting in 2025.

The post GCB Bank reports record GHS 1.91 billion profit before tax in 2024 first appeared on 3News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS