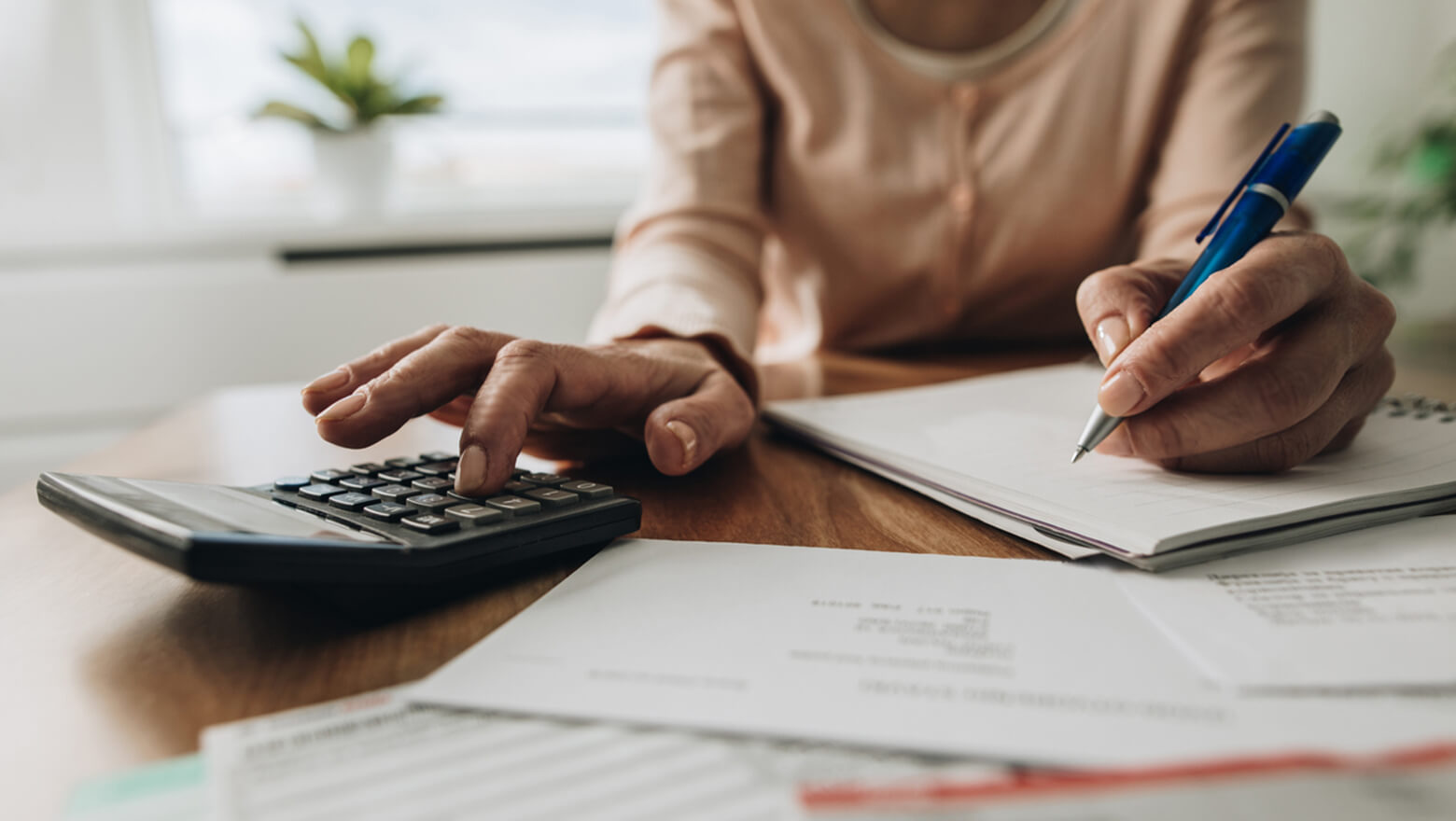

In today’s fast-paced world, managing your finances effectively is more crucial than ever. It's a common struggle to stretch a salary beyond a week, especially with the rising living costs and numerous financial obligations.

However, with some strategic planning and disciplined habits, you can ensure your paycheque lasts longer and helps you achieve financial stability.

Here are six steps to make your salary work for you throughout the month.

1. Create a Realistic Budget

The foundation of good financial management is a well-planned budget. Start by listing all your income sources and fixed expenses, such as rent, utilities, and groceries. Allocate funds for savings and discretionary spending. Be realistic about your spending habits and ensure your budget is sustainable. Tools like budgeting apps or spreadsheets can help you keep track of your expenses and stay within your limits.

2. Prioritise Savings

Pay yourself first by setting aside a portion of your salary for savings before addressing other expenses. Aim to save at least 10-20% of your income. Establish an emergency fund that can cover three to six months' worth of expenses, and consider opening a high-yield savings account for better interest rates. Automated transfers to your savings account can make this process seamless and ensure consistency.

3. Track Your Spending

Keeping a close eye on your daily spending can prevent unnecessary purchases and help you stay within your budget. Use mobile apps or maintain a spending journal to record every expense. Regularly reviewing your spending habits can highlight areas where you can cut back, such as dining out, subscriptions or impulse buys.

4. Cut Unnecessary Expenses

Evaluate your expenditures critically and identify areas where you can save. Cancel unused subscriptions, switch to a more affordable phone plan, and cook at home instead of dining out. Consider buying generic brands, shopping during sales, and using coupons to reduce your grocery bill. Every small saving adds up and contributes to a longer-lasting salary.

5. Plan Your Meals

Meal planning is an effective way to save money and avoid the temptation of takeaways. By planning your meals for the week, you can make a shopping list that ensures you buy only what you need, reducing food waste and grocery costs. Batch cooking and freezing meals can also save time and money, providing convenient, budget-friendly options throughout the week.

6. Avoid Debt and Interest Payments

Minimise the use of credit cards and high-interest loans, as the interest payments can quickly erode your salary. If you have existing debt, prioritise paying it off by making extra payments whenever possible. Consider consolidating high-interest debts into a lower-interest loan to reduce your monthly payments. Living within your means and avoiding new debt will help you retain more of your salary each month.

Stretching your salary beyond a week requires a combination of disciplined spending, strategic planning, and mindful saving. By implementing these six steps, you can gain better control over your finances, reduce financial stress, and work towards a more secure financial future.

Remember, the key is consistency and making conscious decisions about your money to ensure it lasts longer and works harder for you.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS