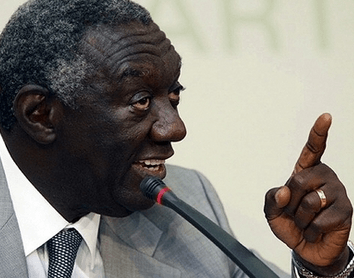

A former Minister of Finance, Dr Kwabena Duffuor, has asked regulatory institutions in the financial sector to prioritise financial inclusion as part of their operational duties to bring more people into the financial system.

Speaking at the 38th Management Day celebration of the University of Ghana Business School (UGBS), Legon, in Accra last Wednesday, the former Governor of the Bank of Ghana (BoG), said it was important to increase the outreach of financial services by the different players within established regulatory frameworks.

The day was celebrated on the theme: ‘Finance and Insurance for Inclusive National Development’, and brought together key stakeholders to deliberate on strategies for harnessing the content delivery of business education towards ensuring effective and efficient performance at the corporate level.

“We require a collaborative stance by regulators, industry players and academia in pursuing this important national agenda,” he said.

He cited universal access, affordable financial services and products, as well as the diverse responsible and sustainable institutions as some dimensions of financial inclusion that needed to be concluded.

Dr Duffuor’s context of regulators included the BoG, the National Insurance Commission, the National Pensions Regulatory Authority and the Securities and Exchange Commission (SEC).

He said in view of the growing importance of finance for all in the overall development agenda, it should be made accessible to small and medium enterprises (SMEs) and people living in rural areas where over 60 per cent were affected by poverty.

He said it was one surest way of promoting inclusive development and reducing poverty, adding that an inclusive financial sector aimed at inclusive national development could generate positive externalities for the government, contributing to job creation and macoeconomic stability.

“From the perspective of poor rural households and SMEs, inclusiveness provides opportunities to borrow and save, offer efficient means of making payments and facilitate investment in housing, education, insurance and firm growth,” he said.

Improving financial access

The Deputy Commissioner of the National Insurance Commission (NIC), Mr Simon Davor, reiterated the need for inclusion in insurance market because many people had been cut off.

He cited budget priority, low education, lack of trust, lack of product suitability to serve people, such as farmers, fisherfolk, among others as some of the factors contributing to the low penetration of insurance in the country.

“What is making it diffiicult for them to make use of insurance? It is because of low income, and the fact that items on the budget are many and priority on the budget ranking makes it diffiuclt to prioritise insurance.”

He also explained that majority of Ghanaians operated in the informal sector, hence their incomes were seasonal and irregular.

He said the NIC was collaborating with the German development cooporation (GIZ) to improve access to insurance products in the country.

Management Day

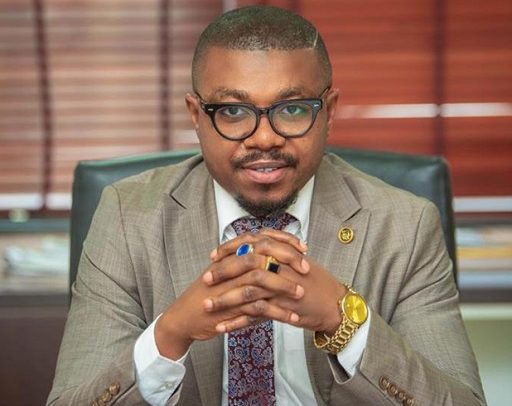

The Dean of the UGBS, Prof. Joshua Yindenaba Abor, said the school continued to introduce innovative programmes to reflect current trends in the market, such that in the area of internationalisation and accreditation it continued to make notable progress.

He said the UGBS Management Day, introduced in 1970, had the objective to bridge and foster a harmonious relationship between industry and academia.

Prof. Abor said this year’s celebration sought to provide a platform for stakeholders, researchers and policy makers to discuss critical issues of finance and insurance for inclusive development.

He said the importance of the financial sector in promoting economic growth and development by mobilising savings and investment was well recognised and that insurance as a risk financing tool could contribute to the mobilisation funds for long term investments to facilitate the growth of the capital market to spur growth and development.

A former Minister of Finance, Dr Kwabena Duffuor, has asked regulatory institutions in the financial sector to prioritise financial inclusion as part of their operational duties to bring more people into the financial system.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS