By Joshua Worlasi AMLANU & Ebenezer Chike Adjei NJOKU

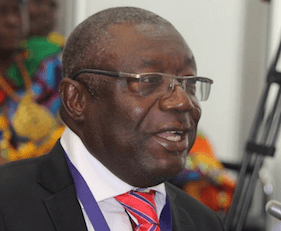

The Minerals Income Investment Fund (MIIF) is set to introduce a dividend payout policy aimed at strengthening its financial independence and enhancing investor confidence, according to its Chief Executive Officer (CEO), Edward Nana Yaw Koranteng.

The policy is expected to govern how dividends are paid to government as MIIF positions itself as a central player in the country’s mining sector and beyond.

Mr. Koranteng highlighted the need for such a policy during a stakeholder conference held under the theme ‘Minerals value addition and value chain development – essential tools for Ghana’s development’, explaining that MIIF’s independence from government interference is crucial to its mission.

He emphasised that the dividend policy will prevent government from arbitrarily transferring funds, which has been a concern for sovereign wealth funds globally.

“The policy aims to cement MIIF’s independence and alleviate any perceptual biases from foreign investors,” he explained.

Mr. Koranteng pointed out that MIIF operates with a mandate to maximise the economic benefits Ghana derives from its mineral resources. As part of this mission, MIIF focuses on value addition across the mining sector, ensuring that the country gains more from the industry.

The dividend payout strategy, he noted, will be instrumental in solidifying this goal.

Expanding royalties net

A significant part of MIIF’s strategy involves expanding the royalties net. Mr. Koranteng explained that MIIF has initiated a framework agreement with the Ghana Revenue Authority (GRA) and other state agencies to ensure that all mining companies pay the appropriate royalties.

This approach is expected to increase revenues significantly, contributing to the Fund’s long-term sustainability and ensuring more funds are available for dividend payouts.

“We are using technology to track royalties and ensure compliance from mining companies. This, combined with our investments in key projects, will increase our revenue base and allow us to meet our dividend obligations,” the MIIF boss said.

MIIF’s use of technology includes a system that allows it to monitor production levels of quarries and gold mines in near real-time, enhancing transparency and accountability in the sector.

Strategic investments, value addition

The Fund’s investment strategy is centred on value addition, particularly in the mining sector.

MIIF has made significant equity investments in key mining companies including Atlantic Lithium and Asante Gold Corporation, both of which have been compelled to list on the Ghana Stock Exchange. Mr. Koranteng emphasised that this allows Ghanaians, including pension funds, to invest in the mining companies and benefit from their profits.

“By taking equity positions in these companies, we ensure that Ghanaians can participate in the mining value chain. Listing on the Ghana Stock Exchange provides an avenue for local investment and strengthens our capital markets,” he added.

One of MIIF’s key projects is its investment in Injaro, a company providing financial support to businesses within the mining sector’s supply chain. MIIF has invested US$25million in Injaro, helping local companies involved in contract mining and supplies to access the funding necessary for competing with international firms.

Furthermore, Mr. Koranteng noted that MIIF is actively working on investments in strategic minerals such as graphite and lithium, which are expected to drive future growth in the mining sector.

These minerals are essential in the global shift toward renewable energy and electric vehicles, and Ghana is positioning itself to be a significant player in these industries.

Projected growth, long-term outlook

MIIF’s long-term projection is to grow its assets to US$6billion within the next 10 years, driven by the expanding royalties net, strategic investments and value addition in the mining sector. Mr. Koranteng expressed confidence that the Fund’s focus on sustainability and diversification will allow it to achieve this ambitious target.

“The future is bright when it comes to gold and other minerals. Our investments, combined with the expected growth in royalties, will ensure that MIIF remains a key contributor to Ghana’s economic transformation,” Mr. Koranteng stated.

The post MIIF to develop dividend policy for long-term sustainability appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS